The Lowest Quote is Often NOT the Lowest Price

A company decides to shop for a new credit card processing account. So online they go, compile a list of companies, send out an RFQ (request for quote), and wait for the offers to roll in. Maybe they meet with 2 or 3 companies – compare “rates” and play one company against the other trying to get “the best deal”. After many meetings and rounds of quotes- they settle on the lowest “rate” – and pat themselves on the back for doing their due diligence and getting a great rate. The big secret of the Merchant Services world – NONE of that matters in the long run!

Sure, you can get a low rate – at the beginning – but for most companies, this is just temporary relief. Before long, they are looking at ever increasing fees, ultimately paying MORE than they were before.

How can this be? The open secret is that EVERY merchant services agreement has a pricing change clause. Yep, they tell you, in writing, that they can change your price at ANY time, for ANY reason with a 30-day notice. So ultimately, that low rate that was so exhaustively negotiated, didn’t mean a thing.

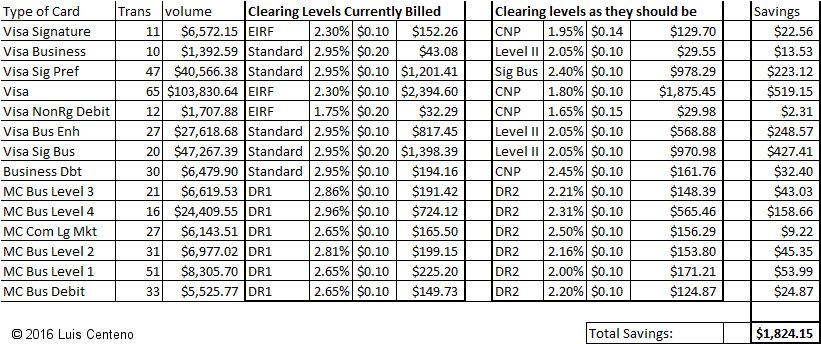

Here is an example:

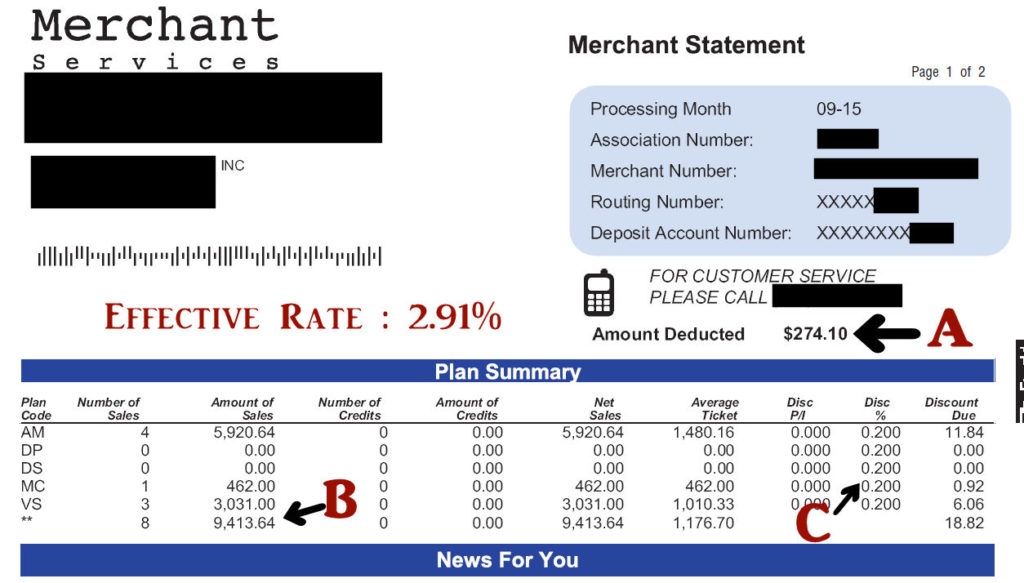

A 1 ½ years ago, this merchant was promised Interchange Plus Pricing (Wholesale plus Markup). They were promised a markup of an unbelievably low 0.20% above cost – as a brand new business with no history. This is a snapshot of one of their first statements from September 2015:

On the graphic above you can see their fees for the month (A), their Volume (B) and the Promised rate of 0.20% (C). The Effective Rate (price all in after all fees) was 2.91% at the time. These are card not present (transactions over the phone, fax, or internet) so this was not a bad Effective rate – however, at only 0.20% Markup, it should have been lower – but that is for another article.

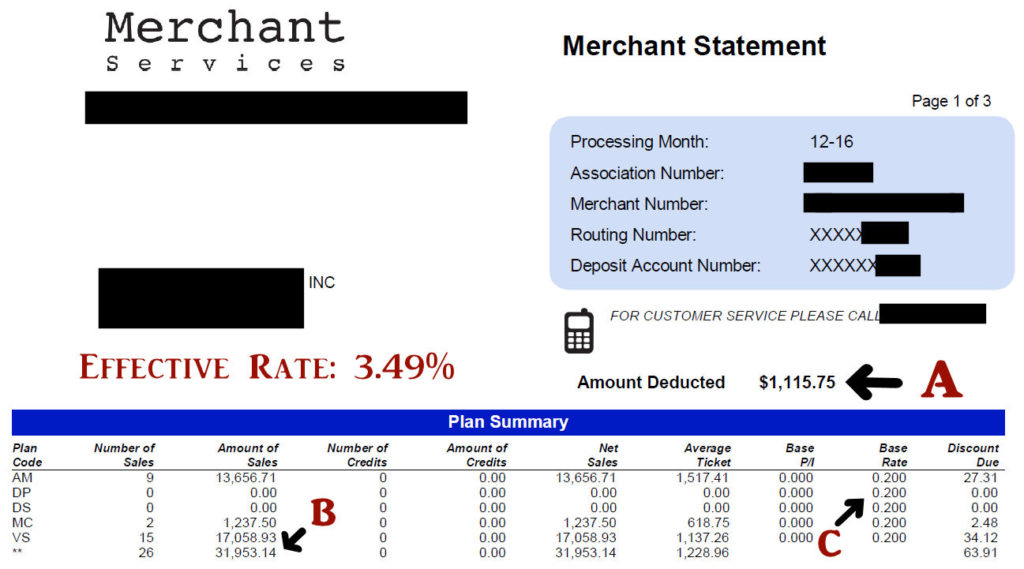

Now, let’s look at a snapshot of December 2016 – just a bit over a year later:

You can see the Total fees again (A), the Volume for the month (B), and the Promised 0.20% Markup (C) – but WAIT, what is this? The Effective rate is not 2.91% as before, NOW it is 3.49%. How can this be? The Markup didn’t change? Right? – They want you to believe that!

The Devil is in the details as they say – There are many parts to merchant services – there are Fees, Dues, and Assessments besides the markup. They can say “markup” didn’t change, while adding more fees and surcharges. “Technically” they can claim they didn’t lie. And before you ask – YES, the BANKS do this too!

It got worse for this merchant, just a month later; their effective rate was at 3.82%! That’s when they finally called me for help! I was able to show them were their other processor was hiding fees on the statement and provide them with a merchant account that I can monitor for them, so this never happens again!

So how can a company protect themselves from these shenanigans? They need a trusted Merchant Services Professional! Shopping for merchant services just based on price can lead a company into a world of issues. I have seen situations that cost companies hundreds even thousands of dollars a month. Ever heard the expression “Penny wise and Dollar Foolish”? Short term savings can lead to long term losses.

Remember, it’s not what they quote – It’s what they actually charge that matters.

© 2017 Luis Centeno / My Merchant Expert. All Rights Reserved.